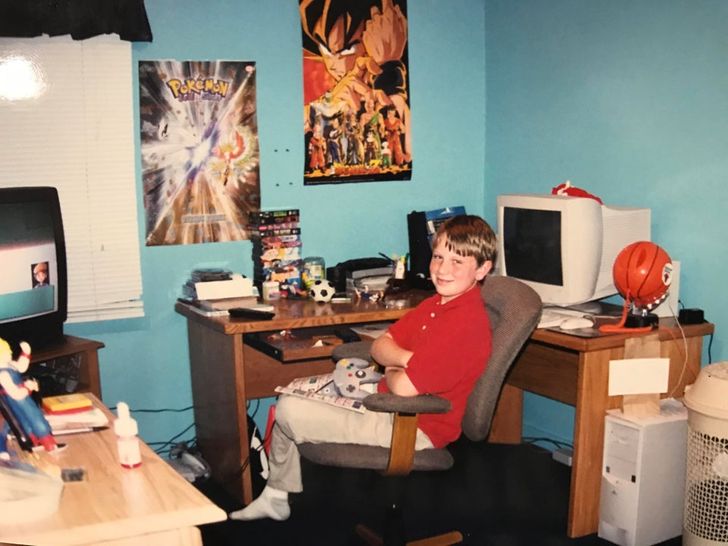

You and your friends stop by the mall.

You go to Gamestop, get some fun N64 games, watch the third Pokemon movie at the AMC theatre, and rent a couple more movies at Blockbuster before calling your mom on a Nokia phone to come pick you up before heading home for a sleepover.

Life is good.

absolute king

Why not?

It’s 2001.

It’s now 20 years later, and not much makes sense. Some of those friends have probably OD’d on opioids and others lost their jobs. Your local mall including Gamestop is abandoned and now boarded up, Blockbuster’s closed permanently, and you’re not allowed to leave your house to go to the AMC.

On top of that, government, media, and corporations preach tolerance, diversity, and the importance of mental health while reminding you constantly how little you matter.

don’t forget to vote – but not for that guy!

For all your troubles, you get a phone with a touchscreen that you don’t actually own.

Don’t tell me you can’t understand why people are angry.

iconic

Welcome to January 2021.

right on schedule

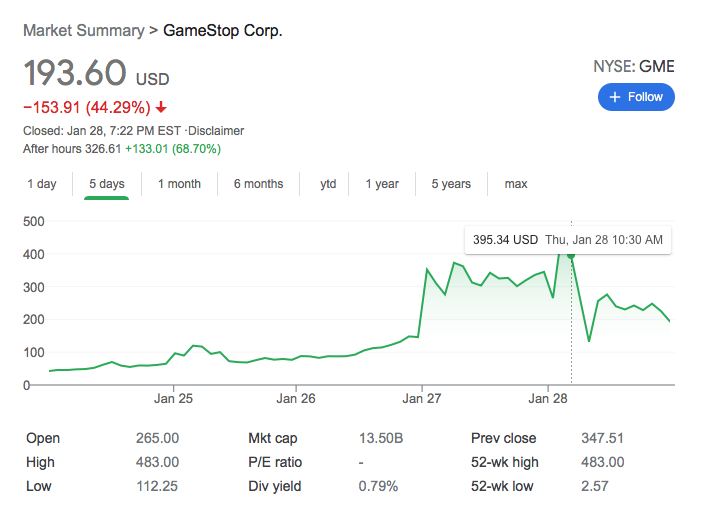

This week, someone on Reddit discovered that a major hedge fund *shorted*, or is betting against, GameStop stock, which has been floundering as of late.

Hedge funds do this frequently to pump up their books – bet that the stock decreases, and when it does, walk away with profit. And it’s easy to bet against brick-and-mortar retail, which has been floundering for years and especially now with virus-related store closures.

stonk goes down

So what would happen if a bunch of people bought GameStop stock? The price would increase, and people would want more.

And those hedge funds that bet against GameStop – like Melvin Capital (net value before this week – $12.5 billion) would take an absolute beating.

Turns out that goddammit – it worked.

stonk goes up

Other stocks that are valued low have been purchased and driven up by Redditors and other everyday investors – AMC, Blockbuster, Nokia among them.

Everything seemed hunky-dory until Thursday morning, when most major e-trading platforms like Robinhood banned the purchase of stocks like GameStop and AMC, forcing investors to sell.

Of course, it’s pure coincidence that Robinhood’s largest customer, Citadel Capital, was forced to bail out Melvin Capital which shorted GameStop.

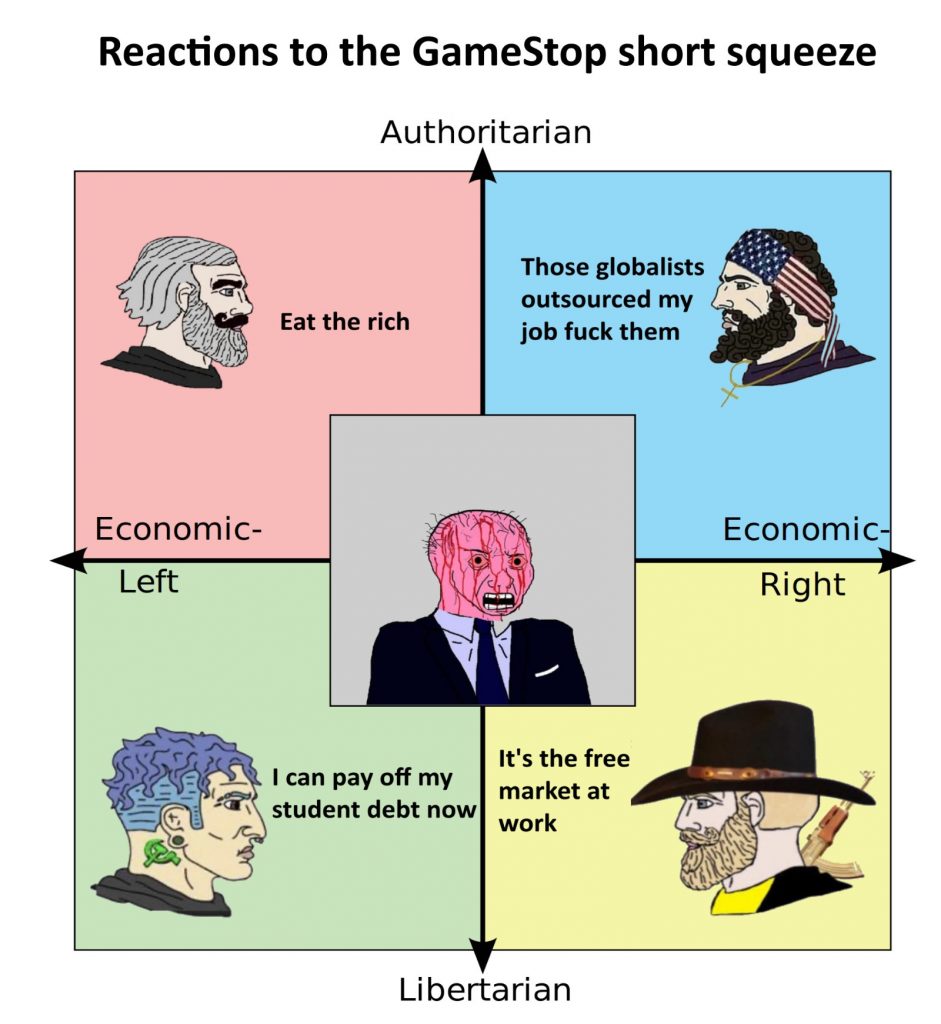

Robinhood roundly gained criticism left, right, and center.

The frenzy has increasingly drawn in policymakers throughout the week. It culminated in rare agreement among Rep. Alexandria Ocasio-Cortez (D-N.Y.), Sen. Ted Cruz (R-Texas) and Donald Trump Jr., who slammed the brokerage Robinhood Financial, a firm catering to younger investors, for suddenly limiting trading in GameStop, AMC Entertainment and other stocks.

It’s rare you find an enemy that has a lower approval rating than neglecting-to-issue-promised-$2000-checks Congress, but hedge funds is one of them.

the only political compass that matters

Speaking of which…

It’s no wonder that many have resorted to trading a few stocks to make income – beats waiting on a check that will never come when you’re *still* not allowed to go back to work.

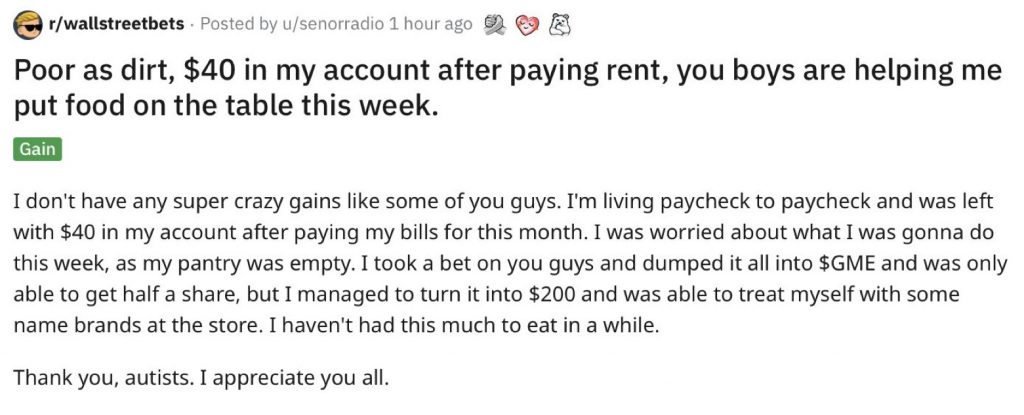

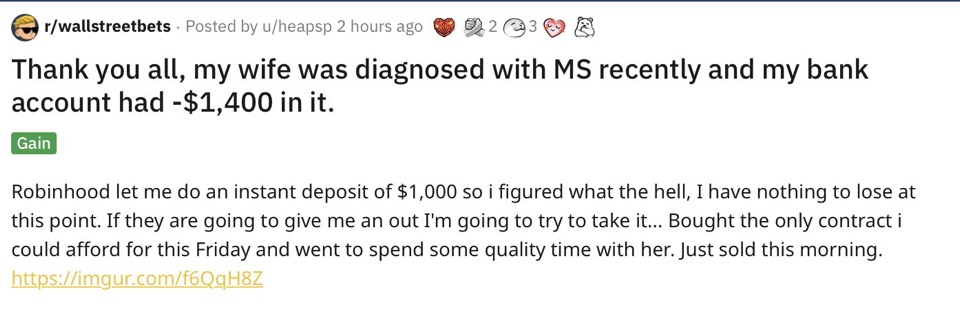

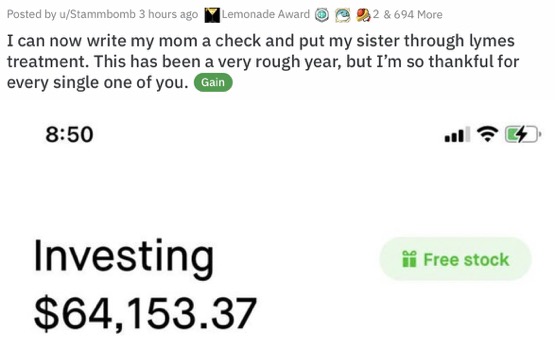

The success stories on r/wallstreetbets – the Reddit board where the GameStop buying craze began – are absolutely heartening:

If you’d told me a few years ago that in 2021, 90s kids, powered by memes, were driving up the price of nostalgia stocks on the market to make a few bucks to make ends meet, I’d wonder what sort of apocalypse befell us where we’d have to resort to such tactics.

How many bad events (9/11, financial crisis, opioid crisis, the death of the middle class, a virus, cities being burned in the name of racial equality, a stolen election) can one generation take before they start to take it out on the institutions that have failed them?

This is a generation told to believe in compounding interest, and left with compounding anger.

Taking prank photos in congressional offices and using memes to drive up the price of a stock is just the beginning.